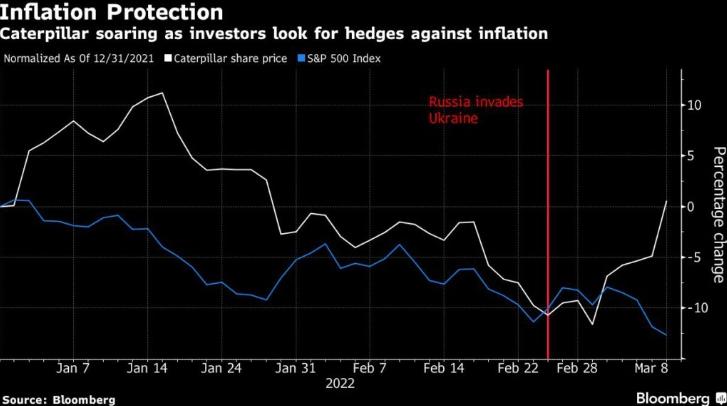

Shares of Caterpillar Inc. posting the biggest five-day gain since the pandemic as investors looking to hedge inflation flock to mining and construction equipment manufacturers.

The company’s shares rose 6.5% on Tuesday, bringing the five-day jump to more than 14%. If growth continues through the close, it will be the biggest move since June 2020. Meanwhile, the S&P 500 has fallen 3.1% over the past five sessions.

“The Russian-Ukrainian crisis has fundamentally changed global commodity markets and is likely to spark a decade of reinvestment similar to what the world experienced in the 1970s,” Jeffreys analyst Steven Volkman wrote in a statement. An analyst briefed Caterpillar on the purchase on Tuesday, saying that as Russia will be excluded from global commodity markets for the foreseeable future, mining, power and agricultural capacity will need to be expanded elsewhere to compensate.

Oil rose to $128 on Tuesday as both the US and UK are expected to impose a ban on energy imports from Russia.

Considered the main engine of the global industrial economy, Caterpillar can look forward to long-term growth as countries and companies begin to invest in expanding their manufacturing capacity. This has made it attractive to investors seeking protection from soaring commodity and oil prices.

“Higher energy prices tend to drive up capital spending, and Caterpillar is one of the few ways to get exposure to oil and gas stocks,” Barclays analyst Adam Seiden said Monday.